The best Asset

Protection & Tax Strategies.

Trust your assets.

The best Asset

Protection & Tax Strategies.

Trust your assets.

Our Unique and Powerful

Trust Structure

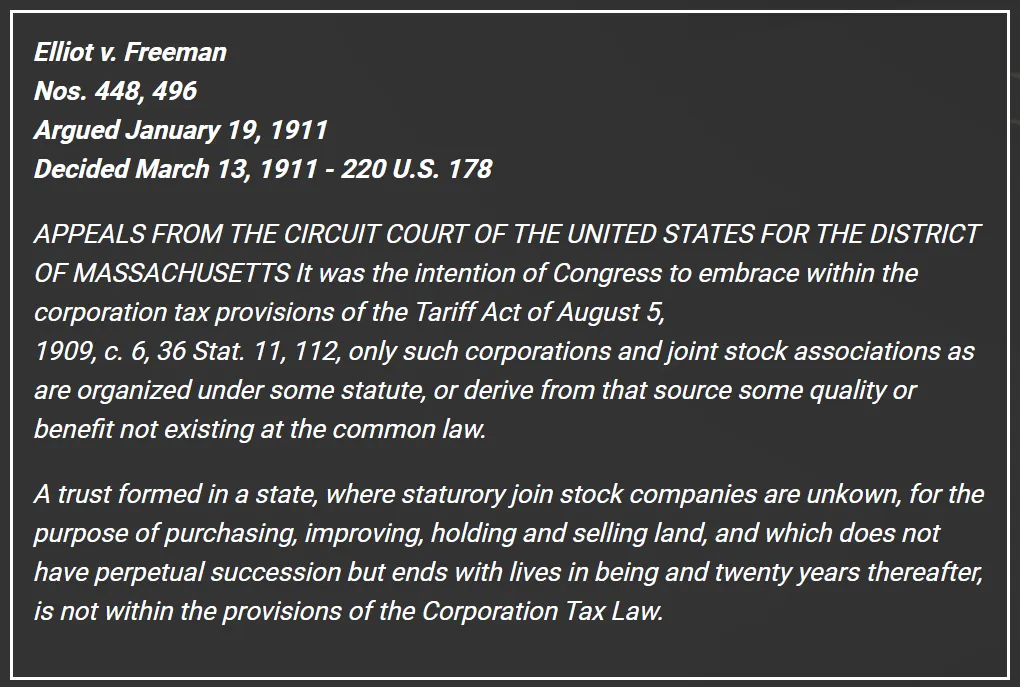

When your assets and money are at stake you don't want to try some new flash in the pan strategy to protect them. The Spendthrift, Non Grantor, Complex, Discretionary and Irrevocable Trust we offer was structured back in 1533. These trust have never been penetrated in nearly 500 years.

So what makes this trust so unique and powerful?

Our Trust is based on Contract Law, not Legislative law. This is a very important differentiation. Our Trust is an contract agreement between private parties creating mutual obligations enforceable by law. The three elements required to create a legal contract are offer, acceptance and consideration, which means the exchange of something of value.

Our Trust is also compliant with IRC 643 which allows the Trust to defer all capital gains, passive income and K1 income for in perpetuity in the corpus of the Trust. Our Trusts will also allow you to convert ordinary business income to passive income within the Beneficiary Trust, which can be deferred for in perpetuity.

No other Trust structure provides this level of asset protection and tax deferment!

Our Unique and Powerful

Trust Structure

When your assets and money are at stake you don't want to try some new flash in the pan strategy to protect them. The Spendthrift, Non Grantor, Complex, Discretionary and Irrevocable Trust we offer was structured back in 1533. These trust have never been penetrated in nearly 500 years.

So what makes this trust so unique and powerful?

Our Trust is based on Contract Law, not Legislative law. This is a very important differentiation. Our Trust is an contract agreement between private parties creating mutual obligations enforceable by law. The three elements required to create a legal contract are offer, acceptance and consideration, which means the exchange of something of value.

Our Trust is also compliant with IRC 643 which allows the Trust to defer all capital gains, passive income and K1 income for in perpetuity in the corpus of the Trust. Our Trusts will also allow you to convert ordinary business income to passive income within the Beneficiary Trust, which can be deferred for in perpetuity.

No other Trust structure provides this level of asset protection and tax deferment!

Start Today!

Start Today!

The 5 Pillars of our Trust:

Non-Grantor

The non-grantor designation exempts the Trust from any alter ego status that brings into action the management or beneficial enjoyment by the Settlor. If the creator of a trust has management of the corpus or is a beneficiary of the trust it becomes a so called living trust which has limited benefits and no tax advantages or asset protection

Irrevocable

In order to have asset protection the Trust must be Irrevocable and non-grantor. This Trust separates the Settlor or Creator from the corpus of the Trust. When assets are irrevocably transferred to Trust they may never revert to the one who is making the endowment or the Settlor of the Trust. Under these terms and conditions upon creation legal separation has occurred and the corpus may not be breached by claimants of the Settlor or endower

Complex

In order to serve the Beneficiaries of the Trust and protect the corpus the Trust must be Complex in nature with terms and conditions that plainly and fully state the powers and limitations of the Trustees. Complex Trusts are governed by terms and conditions that may not be altered or changed by the Trustees and the purpose of the Trust is established once and for all time. The Trustees many also make income declarations stated further herein.

Spendthrift

The Spendthrift Provision of the Trust is the critical element of the document in that no Spendthrift Trust Corpus may be penetrated to reach the assets of that Corpus. Case law upholds this and has upheld this over the many long years of its existence and will continue to uphold it. No judge or court may issue a turnover orders against a properly constructed Spendthrift Trust. The sole exception to this rule of law is fraudulent conveyance to avoid judgment; and this only applies to a Trust created after litigation has been filed not before

Discretionary

The Discretionary terms and conditions of the Trust are established to insure the absolute and sole discretionary power of the Trustee in determining the distribution of the Corpus assets to the Beneficiaries of the Trust. If any single percent of the Corpus is designated to be held or distributed to one or more Beneficiary(ies), the Discretionary designation of the Trust would be invalid. This in no way would affect the asset protection but could adversely affect the taxable structure of the Trust.

The Internal Revenue Code is explicit and clear with regard to the Discretionary nature of a Trust, plainly stating that if a fiduciary has the sole and absolute authority to designate something as Extraordinary Dividends or Taxable Stock Dividends, and that designation is paid to the Corpus of the Trust and not subject to distribution, this is not income to the Trust according to Rule 643. Another advantage to this Trust is that any asset held in the Corpus of the Trust, when sold, is not subject to capital gains taxes.

Thus, our Beneficiary Trust was created and written to be Non-Grantor, Irrevocable, Complex, Discretionary, Spendthrift Trusts and Copyrighted.

Trustees of our Trusts refer to them as the Gift that Keeps on Giving!! There are so many applications for the Trusts in which they bring extortionary value to the Beneficiaries and Trustees.

The 5 Pillars of our Trust:

Non-Grantor

The non-grantor designation exempts the Trust from any alter ego status that brings into action the management or beneficial enjoyment by the Settlor. If the creator of a trust has management of the corpus or is a beneficiary of the trust it becomes a so called living trust which has limited benefits and no tax advantages or asset protection

Irrevocable

In order to have asset protection the Trust must be Irrevocable and non-grantor. This Trust separates the Settlor or Creator from the corpus of the Trust. When assets are irrevocably transferred to Trust they may never revert to the one who is making the endowment or the Settlor of the Trust. Under these terms and conditions upon creation legal separation has occurred and the corpus may not be breached by claimants of the Settlor or endower

Complex

In order to serve the Beneficiaries of the Trust and protect the corpus the Trust must be Complex in nature with terms and conditions that plainly and fully state the powers and limitations of the Trustees. Complex Trusts are governed by terms and conditions that may not be altered or changed by the Trustees and the purpose of the Trust is established once and for all time. The Trustees many also make income declarations stated further herein.

Spendthrift

The Spendthrift Provision of the Trust is the critical element of the document in that no Spendthrift Trust Corpus may be penetrated to reach the assets of that Corpus. Case law upholds this and has upheld this over the many long years of its existence and will continue to uphold it. No judge or court may issue a turnover orders against a properly constructed Spendthrift Trust. The sole exception to this rule of law is fraudulent conveyance to avoid judgment; and this only applies to a Trust created after litigation has been filed not before

Discretionary

The Discretionary terms and conditions of the Trust are established to insure the absolute and sole discretionary power of the Trustee in determining the distribution of the Corpus assets to the Beneficiaries of the Trust. If any single percent of the Corpus is designated to be held or distributed to one or more Beneficiary(ies), the Discretionary designation of the Trust would be invalid. This in no way would affect the asset protection but could adversely affect the taxable structure of the Trust.

The Internal Revenue Code is explicit and clear with regard to the Discretionary nature of a Trust, plainly stating that if a fiduciary has the sole and absolute authority to designate something as Extraordinary Dividends or Taxable Stock Dividends, and that designation is paid to the Corpus of the Trust and not subject to distribution, this is not income to the Trust according to Rule 643. Another advantage to this Trust is that any asset held in the Corpus of the Trust, when sold, is not subject to capital gains taxes.

Thus, our Beneficiary Trust was created and written to be Non-Grantor, Irrevocable, Complex, Discretionary, Spendthrift Trusts and Copyrighted.

Trustees of our Trusts refer to them as the Gift that Keeps on Giving!! There are so many applications for the Trusts in which they bring extortionary value to the Beneficiaries and Trustees.

"The secret to success is to own nothing,

but control everything!”..... The next question should be, as to how?

"The secret to success is to own nothing, but control everything!”..... The next question should be, as to how?

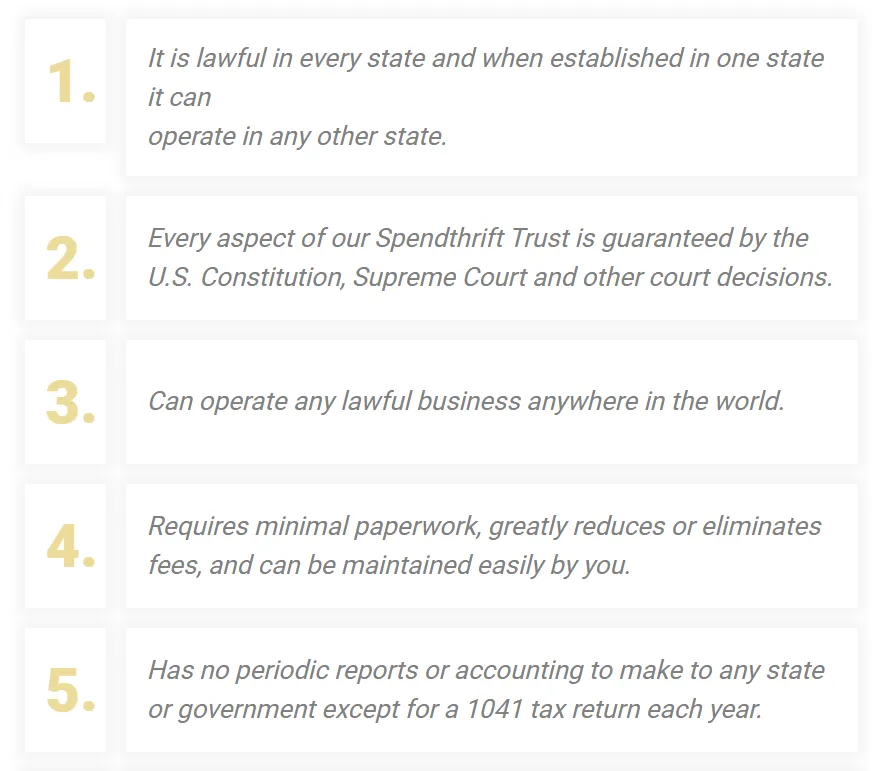

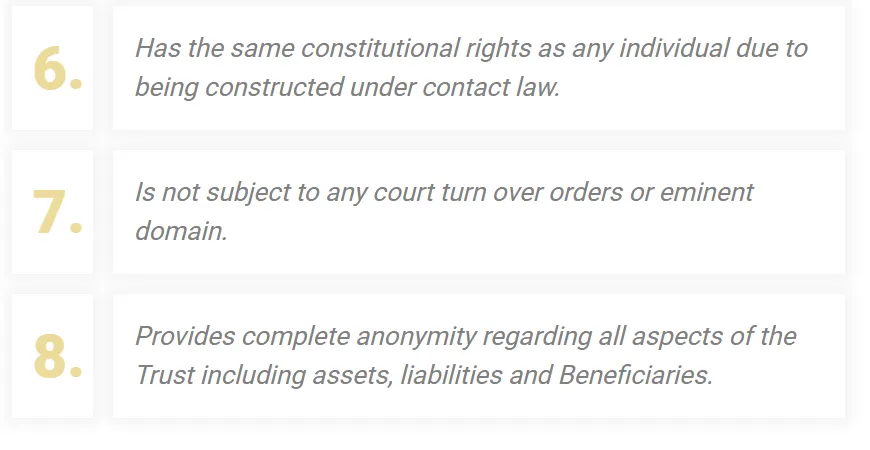

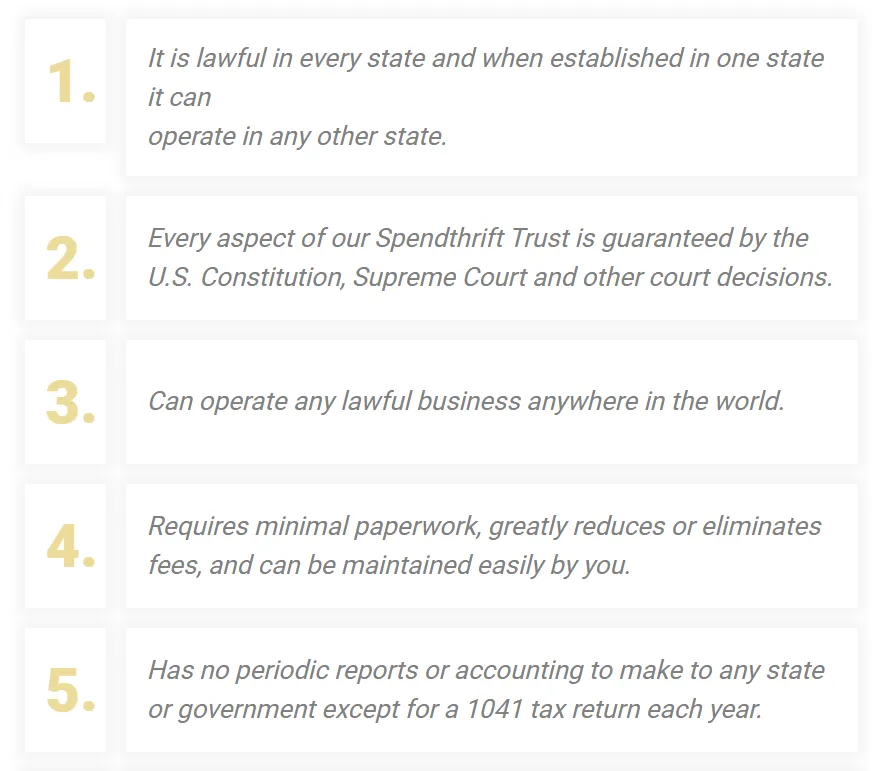

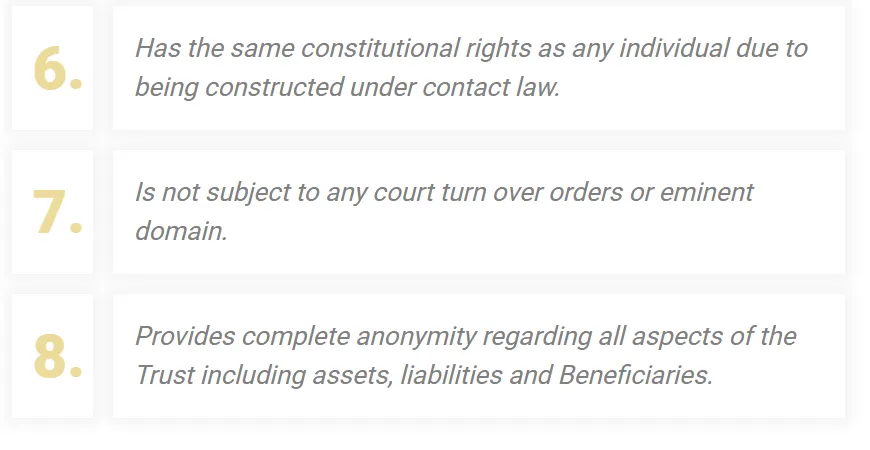

Key Advantages of our Spendthrift Trust

A contract in the form of a Spendthrift Trust Organization, does not owe its existence to any act of the legislature. The authority for its creation is the common law right of the parties to enter into a contract which the Constitution recognizes. According to American law, the government cannot regulate or impose a tax upon a right. Our “right to contract” according to the Constitution of the United States, Article. §10 is unimpariable.

That means that it is not within the power of the government or even a judge to change one word of a Contract of Trust. Once the property is transferred into a Spendthrift Trust Organization, it is subject to its own indenture, which governs and, protects the property held by it. The government can ONLY regulate and tax entities it creates.

Key Advantages of our Spendthrift Trust

A contract in the form of a Spendthrift Trust Organization, does not owe its existence to any act of the legislature. The authority for its creation is the common law right of the parties to enter into a contract which the Constitution recognizes. According to American law, the government cannot regulate or impose a tax upon a right. Our “right to contract” according to the Constitution of the United States, Article. §10 is unimpariable.

That means that it is not within the power of the government or even a judge to change one word of a Contract of Trust. Once the property is transferred into a Spendthrift Trust Organization, it is subject to its own indenture, which governs and, protects the property held by it. The government can ONLY regulate and tax entities it creates.

Start reducing your

tax liability now!

Start reducing

your tax liability now!